The default summons or payment order

A default summons often triggers insecurity, fear or even shame on the recipient's side. If you have received a default summons, it is best to contact the claimant, the authorised debt collection agency or the authorised lawyer directly. Even if you think the claim is not justified, you need to act quickly to resolve the matter. "Sitting it out" or ignoring it will not help you in this situation. Here you can find out what a default summons means and what you need to pay attention to if you have received one.

The most important questions at a glance

Definition of a default summons

A default summons is also called an order for payment or a demand for payment. The application for a default summons initiates judicial dunning proceedings. The default summons is a judicial document that is used to assert a previously unpaid claim.

When a default summons is applied for in Germany, the dunning court checks whether the formal requirements are met. The competent central dunning court is responsible for issuing and subsequently serving the default summons. The order for payment is served by means of an affidavit of service. In this way, the statute of limitations of the claim is initially prevented ("inhibited"); otherwise, this regularly occurs after three years.

The two-week period during which you, as the recipient of the order for payment, have the opportunity to react and, if necessary, to object to it, begins when the document is served. Only after the expiry of the two-week period will the application for the enforcement order be made, which is necessary to carry out an enforcement - unless you have lodged an objection against the default summons.

Most important functions of the default summons

The default summons ...

- is issued by the competent Central Dunning Court at the request of the applicant,

- first interrupts the running of the limitation period,

- serves as a tool for the recovery of monetary claims where the defendant does not pay voluntarily,

- is a prerequisite for an enforcement order, which later enables compulsory execution,

- is more cost-effective and time-saving than a civil action, and it may also enable enforcement quicker.

I have received a default summons - what should I do?

Have you received a default summons? No need to panic! The default summons is not yet an enforceable title. Now it is important that you check the underlying claim carefully. It is imperative that you respond to the summons within the deadline of 14 days, and if necessary, that you object to it. Otherwise you risk receiving an enforcement order. Once the enforcement order is legally binding, it can be enforced against you for 30 years.

React correctly to an order to pay!

Responding correctly to justified claims

If you have received a default summons, you should react as quickly as possible and pay the claim if it is justified. Sitting out and ignoring it is not a solution! This is because the enforcement order usually follows shortly afterwards, which can result in compulsory execution and registration with a credit agency. Leasing, obtaining loans or renting a flat will then become much more difficult.

Responding correctly to unjustified claims

If the claim has already been settled or is not justified, please contact the claimant or the authorised debt collection agency or lawyer immediately. In the best case, the problem can be resolved quickly and amicably, and the judicial dunning proceedings can be ended in an uncomplicated manner.

You could not find a solution with the applicant or the authorised debt collection agency or lawyer? Then you should file an objection against the default summons. It is important that you formulate the reasons as detailed as possible and enclose copies of the evidence directly. However, please never hand over originals!

Payment order not justified?

If you do not agree with the order for payment, it is best to clarify this as soon as possible directly with the applicant or the legal representative.

An out-of-court settlement is always the best and most cost-effective way!

Requesting an order to pay - this is how it works

Whether landlord, craftsman or online trader - in the course of his business life, almost every entrepreneur is confronted at some point with customers who are unable or unwilling to pay. In such cases, the dunning procedure is a fast and cost-effective alternative to civil legal action. Also for private individuals who, for example, do not get the purchase price refunded by the seller after a proper return of goods, the judicial dunning procedure offers a good possibility - without expensive civil proceedings - to settle their claims.

Important requirements for the default summons

Only monetary claims can be asserted with a judicial dunning procedure. For other claims, such as the delivery of goods or the eviction of living space, the judicial dunning procedure is excluded.

The following requirements should be met in order to apply for an order for payment:

- The claim can be proven by a contract, an invoice or a comparable document.

- The claim is due and the contracting party is in default of payment.

- The claim relates to the payment of a certain sum of money in domestic currency.

- The due date of the payment is not dependent on a consideration or the consideration has already been provided.

- The exact postal address of the contractual partner is known.

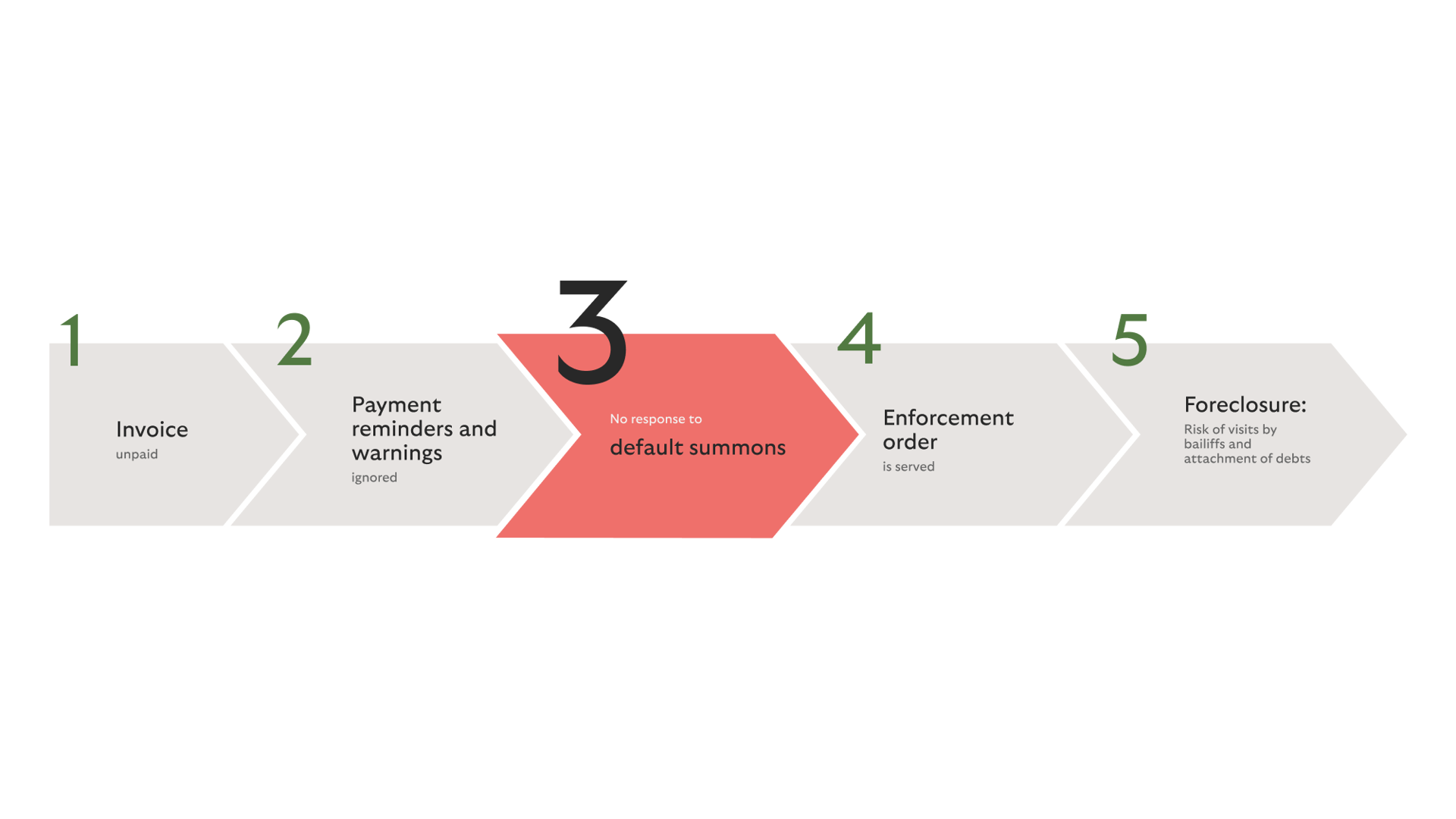

The sequence of the judicial dunning procedure

The judicial dunning procedure is mainly used when out-of-court reminders have been unsuccessful. In principle, every citizen can apply for the issuance of a default summons at the competent central dunning court without any problems; it is not necessary to hire a lawyer for this purpose. Of course, debt collection agencies or lawyers can also use the judicial dunning procedure to collect debts for their clients.

What does a default summons cost?

The costs for judicial dunning proceedings are regulated uniformly and are based on the German Law on Court Costs (Gerichtskostengesetz, GKG). How expensive the dunning proceedings are in each individual case depends on the so-called value in dispute (i.e. the amount of the claim). The Central Dunning Court charges a factor 0.5 fee on the value in dispute for the application for a default summons, but at least 36.00 euros.

If the claimant commissions a lawyer or a debt collection agency to conduct the judicial dunning procedure, additional proceedings costs will be added; these must initially be paid by the claimant.

A debt collection agency may charge the same remuneration for the judicial dunning procedure as a lawyer, i.e. following the Lawyers' Remuneration Act (RVG) a remuneration in the amount of a factor 1.0 fee for the default summons and a further remuneration in the amount of a factor 0.5 fee for the enforcement order. To this will be added expenses, in particular for postal and telecommunication costs, as well as value-added tax.

If the claim is justified and the dunning procedure is successful, the defendant is obliged to reimburse the claimant for the court and procedural costs incurred; during the automatic processing by the Central Dunning Court, the court and procedural costs incurred are already automatically included in the order for payment. It is therefore not necessary for the claimant to invoice the fee for the order for payment separately or to add it to his claim.

Overview of the court costs

The higher the value in dispute, the higher the court costs incurred. This table shows which court costs are incurred for a default summons:

|

Value in dispute |

Fees for a default summons |

|

up to EUR 1,000.00 |

minimum fee EUR 36.00 |

|

from EUR 1,000.01 to EUR 1,500.00 |

EUR 39.00 |

|

from EUR 1,500.01 to EUR 2,000.00 |

EUR 49.00 |

|

from EUR 2,000.01 to EUR 3,000.00 |

EUR 59.50 |

|

from EUR 3,000,01 to EUR 4,000,00 |

EUR 70.00 |

|

from EUR 4,000.01 to EUR 5,000.00 |

EUR 80.50 |

|

from EUR 5,000.01 to EUR 6,000.00 |

EUR 91.00 |

|

from EUR 6,000.01 to EUR 7,000.00 |

EUR 101.50 |

|

from EUR 7,000.01 to EUR 8,000.00 |

EUR 112.00 |

|

from EUR 8,000.01 to EUR 9,000.00 |

EUR 122.50 |

|

from EUR 9,000.01 to EUR 10,000.00 |

EUR 133.00 |

|

from EUR 10,000.01 to EUR 13,000.00 |

EUR 147.50 |

|

from EUR 13,000.01 to EUR 16,000.00 |

EUR 162.00 |

|

from EUR 16,000.01 to EUR 19,000.00 |

EUR 176.50 |

|

from EUR 19,000.01 to EUR 22,000.00 |

EUR 191.00 |

|

from EUR 22,000.01 to EUR 25,000.00 |

EUR 205.50 |

|

from EUR 25,000.01 ... |

... |

Withdrawal of a default summons: Can a default summons be withdrawn?

To err is human. How easily can it happen that a payment received is not booked in time or returned goods are not assigned to an account in time? If the claimant realises after service of the default summons that he is in the wrong, he can withdraw the application for the default summons - but only if the defendant has not yet been served with an enforcement order. As soon as adversary proceedings have been launched, withdrawal is no longer possible.

The withdrawal must be declared to the competent Central Dunning Court in writing or electronically. In addition, the defendant must also be served with the withdrawal of the application if they have already received the default summons. In this case, the costs for the default summons are borne by the applicant. Furthermore, it is possible that the defendant has also already instructed a lawyer and claims the costs incurred for this.

If the order for payment is withdrawn, the applicant shall bear the costs of the dunning procedure.

Default summons - conclusion

An out-of-court settlement is always the best and most cost-effective way.

The application for a default summons is the start of the judicial dunning procedure. This is often the only way for the claimant to secure the claim without initiating legal action if the defendant does not pay the claim voluntarily. With the judicial dunning procedure, the claimant has an effective tool at hand to secure claims quickly and inexpensively. In addition, the default summons is a prerequisite for applying for an enforcement order, which enables enforcement measures, such as seizure of accounts or wages after the order has become final. Avoid further costs or even compulsory execution measures and react to an order for payment in good time!

Identity

Please understand that for reasons of readability we only use the grammatically masculine form when referring to persons. This always refers to people of any gender identity.