Collect faster, recover more

Strategic Debt Collection — powered by data, AI, and experts — designed to help your customers resolve their debt.

Your strategic partner for debt collection

We understand what people need in financially difficult moments. That’s how we reach them, with direct access to solutions. By supporting individuals empathetically, we build trust, preserve relationships, and secure sustainable returns.

We use AI thoughtfully — only where it adds value. It guides decisions, shapes communication, and improves outcomes. Always with expert oversight.

With deep experience across telco, utilities, mobility, financial services, e-commerce, and insurance, and backed by Bertelsmann, we combine operational precision with full financial independence. No leveraged debt. No shortcuts. Just a solid foundation for sustainable growth in over 20 countries.

Debt Collection starting with the user

Effective debt collection begins with understanding your customers. Our platform dynamically adapts to each individual, informed by millions of interactions. From early-stage recovery to legal and long-term tracking, machine learning continually adjusts paths, communication, and channel mix based on consumer behavior and portfolio signals.

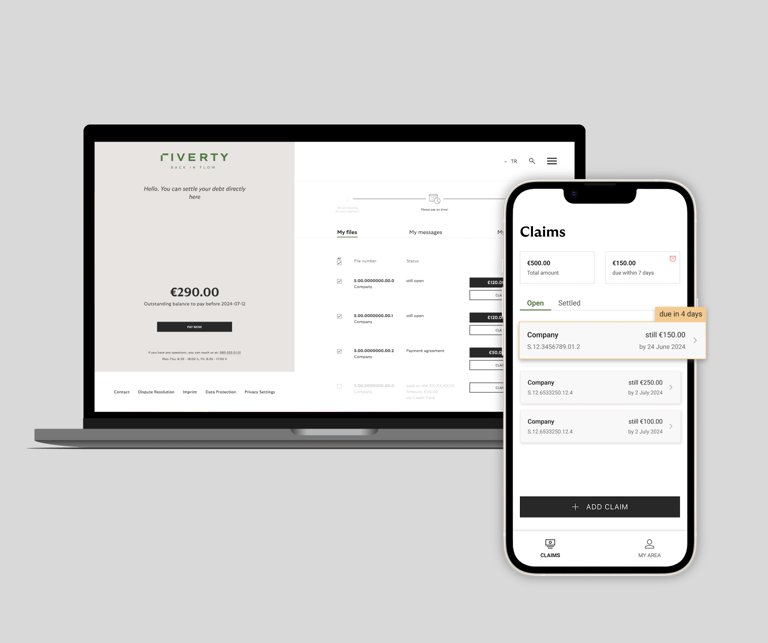

A better way for your customers to get back on track

Our consumer portal and app let your customers resolve their debts their way: guided, transparent, and on their terms. From personalized payment plans to tailored reminders, we help people take control — and it works.

Payments come in 25% more reliably and nearly a day sooner compared to offline. All with a few taps.

A great digital experience is only the first step. Riverty also brings every customer interaction together: personalized, seamless, and orchestrated for results.

Ready to turn receivables into results?

|

|

Axel Kulick Axel Kulick, Vice President of Sales Debt Collection & Debt Purchase |

Plug in. Scale fast. Stay audit-ready.

Whether you’re live in one region or rolling out across markets, our collection platform scales with precision — without adding complexity. One connection gives you the power to grow, stay compliant, and move fast.

- RESTful API with real-time sync and bidirectional connectivity

- Structured onboarding from credentials to testing to productive go-live

- Fallback logic and automated error reporting

- Certified infrastructure according to ISO 27001, ISO 9001 and GDPR standards

Frequently Asked Questions about Debt Collection

Riverty specializes in enterprise-scale receivables and complex, high-volume portfolios. Our platform supports organizations managing thousands of claims per month, with seamless integration, automation, and consistent performance at scale.

Yes. Riverty is registered under the German Legal Services Act (RDG), listed in the Legal Services Register, and fully GDPR-compliant. We meet the latest requirements of the VVInkG, and our systems are certified to ISO 27001 (information security) and ISO 9001 (quality management). As a member of the BDIU, we uphold the highest standards for registered debt collection companies in Germany.

Riverty provides debt collection solutions in 20+ countries, including Germany, Austria, Switzerland, the Nordics, the Benelux region, France, Italy, Spain, and the United States. In some countries, we operate through trusted local partners who are fully integrated into our compliance, performance, and reporting ecosystem. This hybrid model lets you manage international recovery centrally while ensuring local compliance.

Riverty’s platform coordinates international debt collection in over 20 countries through a single interface and contract. We handle local execution with trusted partners, ensuring legal compliance, consistent communication, and unified reporting. This centralized approach gives you clear oversight and performance tracking wherever your customers are located. For more information, visit our International Collections page.

Riverty provides a RESTful API that supports real-time data exchange, status updates, and case-level automation. For clients using SAP (IS-U, CRM, ERP), we offer native integration. We also support secure flat file transfers (CSV, XML) with built-in error handling and fallback workflows. Our onboarding process ensures fast and reliable implementation with minimal dependencies.

Yes. Riverty’s client portal and API allow you to update, flag, or withdraw individual claims, ensuring full flexibility and control over your collections strategy even after initial handover.

Yes. Riverty configures tailored workflows for claims that require special handling - such as flagged disputes, legal holds, or compliance restrictions. These flows are implemented during onboarding and managed through a central process engine, providing full transparency and traceability.

Yes. Riverty’s operations are built for scale. We handle daily high volumes and can easily accommodate spikes caused by seasonality, system migrations, or campaign cycles. Our automation and expert teams ensure stable performance and compliance even during peak periods.

Riverty offers real-time, portfolio-wide visibility into your collections performance. Key metrics include recovery rates, complaint ratios, contact effectiveness, aging structures, and process statuses. Reports can be tailored to your organization’s needs and are accessible through our client portal. Strategic insights are delivered via a live dashboard that supports benchmarking, trend analysis, and custom reporting formats.

Consumers engage with Riverty through a combination of physical and digital channels, including letters, email, SMS, voice assistants, and live phone support. Our self-service portal allows them to review balances, set up payment plans, request deferrals, and communicate directly. In Germany, these features are also available via our mobile app. The entire experience is designed to be respectful, accessible, and fully compliant with all legal standards.

Yes. Riverty offers hybrid models that allow you to start with active collection and transition to debt purchase, or split your portfolio between the two approaches. This flexibility aligns your recovery, liquidity, and resource strategies within a single partnership. For more information, visit our Debt Purchase page.

Riverty provides a dedicated team that includes a Key Account Manager, operational experts, and access to legal and data specialists. We offer structured onboarding, direct communication, regular performance reviews, and collaborative planning sessions. This support model helps you optimize performance while staying aligned with your internal goals and compliance obligations.