Insights

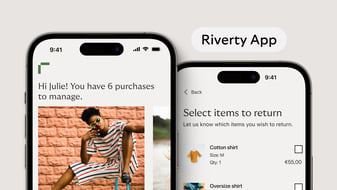

Read about Riverty's journey and how we aim to be the most human centric fintech.

Beyond Checkout: Where Fashion Brands Lose Margin

For fashion ecommerce brands, the sale isn’t the finish line – it’s the starting point for a set of processes that quietly determine how much margin actually gets kept. While most attention focuses on conversion rates and average order values, the real cost often begins after checkout. Returns, refunds, and payment handling don’t just affect cash flow – they directly shape long-term profitability. The challenge is that these post-purchase processes are structural realities in fashion, not occasional exceptions. High return rates are built into the category, refund timelines matter to customers and finance teams alike, and payment reconciliation affects operational efficiency across the business. Yet these margin levers are frequently underestimated, treated as back-office concerns rather than strategic priorities.

Buy Now, Pay Later continues to evolve. Early models were primarily designed for convenience and immediate purchasing decisions. Today, financial well-being, budgeting support, and responsibility have moved into focus. Consumers expect guidance, transparency, and support in an increasingly complex payment environment. Responsible BNPL plays a central role in meeting these expectations.

Payment Method Marketing: Merchant Growth Through Payment Strategies

Payment methods have long been viewed primarily as technical infrastructure, even though they play a visible and influential role in the purchasing process. In the competition for attention, checkout conversion, and customer retention, they are becoming central to strategic decision-making. Payment method marketing describes this shift and opens new opportunities for merchants to reach their growth goals more effectively.

Open Book Policy in NPL sales: why buyer transparency is now a governance issue

Why Open Book policy is becoming a governance imperative in NPL sales: how buyer transparency on pricing logic and assumptions strengthens explainability, internal alignment and long-term credibility in regulated markets.