Insights

Read about Riverty's journey and how we aim to be the most human centric fintech.

Data-Driven Collections: Strategies for Effective Recovery Management

Effective collections today are built on data that reveal behavioral patterns, communication responses, and payment opportunities. Organizations that use these insights systematically can steer their processes with greater precision and can improve recovery measures. What matters is not the volume of data available, but the ability to translate it into clear, actionable steps, from identifying the right moment for outreach to selecting the most effective communication channel and segmenting audiences with meaningful accuracy.

SAP ECC to SAP Cloud ERP: How to keep Finance operating predictably during SAP migration

SAP S/4HANA (now positioned by SAP as its Cloud ERP) is the next step for organisations moving on from SAP ECC. Most Finance leaders are already getting ready for the change. But what happens to your daily finance work while the migration is happening? How will you react when costs rise, key people get pulled into project work, and month-end still has to finish on time?

Beyond Checkout: Where Fashion Brands Lose Margin

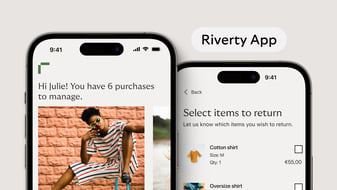

For fashion ecommerce brands, the sale isn’t the finish line – it’s the starting point for a set of processes that quietly determine how much margin actually gets kept. While most attention focuses on conversion rates and average order values, the real cost often begins after checkout. Returns, refunds, and payment handling don’t just affect cash flow – they directly shape long-term profitability. The challenge is that these post-purchase processes are structural realities in fashion, not occasional exceptions. High return rates are built into the category, refund timelines matter to customers and finance teams alike, and payment reconciliation affects operational efficiency across the business. Yet these margin levers are frequently underestimated, treated as back-office concerns rather than strategic priorities.

Buy Now, Pay Later continues to evolve. Early models were primarily designed for convenience and immediate purchasing decisions. Today, financial well-being, budgeting support, and responsibility have moved into focus. Consumers expect guidance, transparency, and support in an increasingly complex payment environment. Responsible BNPL plays a central role in meeting these expectations.