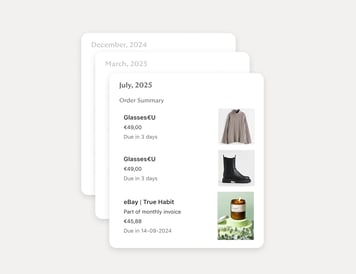

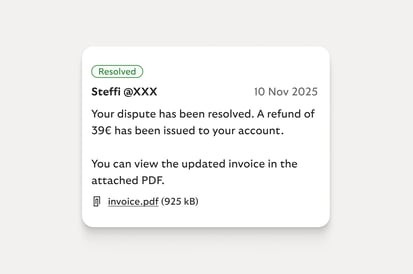

When items are returned or orders change, invoice balanced adjusts automatically. During the return window, Riverty pauses payment reminders and customers stay informed without extra effort. This means less friction for shoppers, and fewer questions for your team.

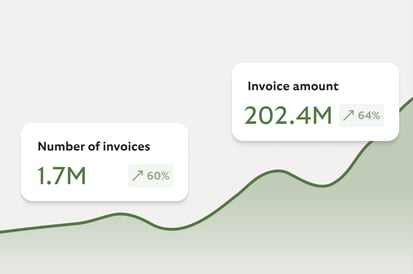

Buy Now, Pay Later solutions built for merchants

From checkout to post-purchase, Riverty supports the full customer journey with flexible payment options that work reliably in the background – so you can focus on building your business.

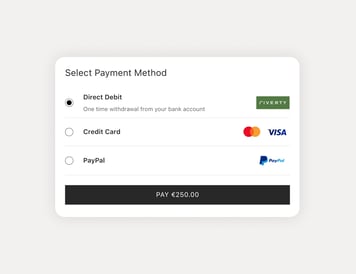

Easy checkout, higher conversion

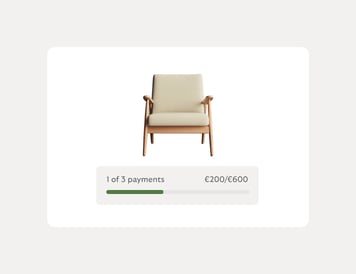

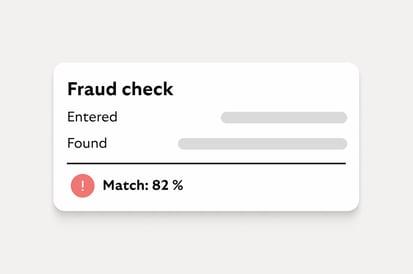

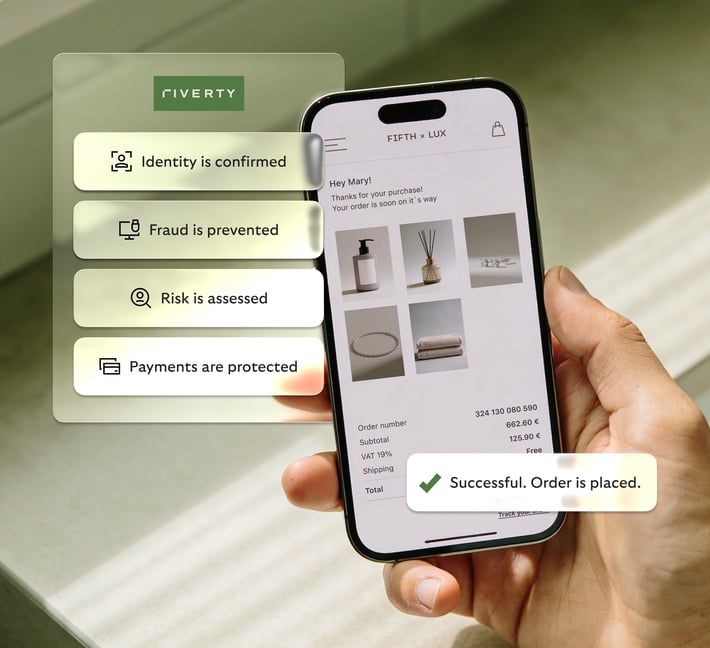

Riverty powers a seamless Buy Now, Pay Later checkout experience. Protecting merchants against fraudulent and unauthorized purchases, while at the same time protecting consumers against purchases they cannot afford. Fewer steps and clear options reduce drop-off and increase conversion, without disrupting your existing flow. And customers complete their purchase quickly with payment methods they already trust.

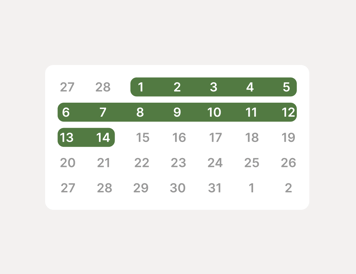

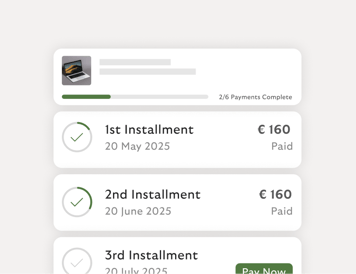

Flexible payment options

Offer flexible invoice and instalment payments that customers recognize and trust – integrated into your checkout without disruption.

Would you like to know more? Let’s talk.

|

Marija Loncar-Schindewolf

Head of Sales |

A post-checkout experience that matters

Support that extends beyond the sale

Post-checkout is where trust, clarity, and brand experience continue – and where Riverty keeps working behind the scenes.

Trusted by Europe’s top retailers

![]()

We knew that payments play a crucial role in customer experience, and Riverty provided exactly what we needed: a seamless, flexible, and reliable solution. Our customers love the ability to choose how and when they pay, and we’ve seen a real impact on our sales during peak periods.

|

|

Franziska Schneider |

Get started with our partners

Already using Adyen, Mollie, Pay, Shopify, or another PSP or platform? Keep your current setup and add Riverty’s Buy Now, Pay Later through seamless integration. Whether you’re rethinking your in-house solution, tired of compromising on brand control, or simply looking for a BNPL provider you can trust, we’ll show you what reliable partnership can look like.

Your frequently asked questions, our answers

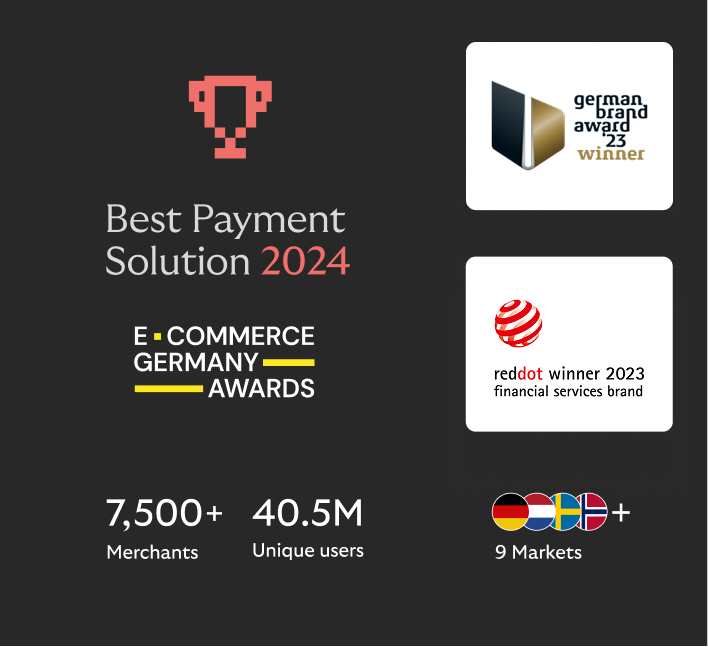

Riverty is one of Europe’s largest Buy Now, Pay Later providers, operating across seven countries with seamless cross-border payment capabilities. What sets us apart: an extensive PSP network for easy activation, industry-low dispute chargebacks through automated management, and a merchant-first approach that keeps your brand in control of the customer experience throughout the payment journey.

Read more about our award-winning approach.

Riverty handles payment-related communications including friendly reminders via SMS, push notifications, email, and postal mail to keep customers informed. We also share helpful guidance about app features and payment options. What we don’t do: promote competing merchants or influence customers away from your business. Our customer support stays focused on payment clarity, not cross-selling.

Pricing depends on your specific setup and integration. Contact your PSP for detailed pricing information, or reach out to our sales team directly to discuss your business needs.

Riverty’s fraud prevention combines real-time risk scoring, continuously refined machine learning models, and advanced account takeover protection. Our identity verification methods include BankID, MitID, iDIN, VideoID, Open Banking, and bank-issued OTPs to ensure secure customer verification. As a BaFin-regulated payment institution, we maintain full regulatory compliance across all European markets where we operate.

Riverty’s award-winning customer service team handles all payment-related support for Buy Now, Pay Later transactions, reducing average handling times and increasing first-contact resolution rates by up to 20%. We also provide status-sharing tools so your customer service team can answer basic payment questions directly when needed.

To optimize your Buy Now, Pay Later checkout experience: implement Riverty messaging and badges on your homepage, add our sales enabler to product pages, use our recommended headlines and taglines at checkout (available for both embedded and hosted solutions), and let Riverty handle terms and conditions during the hosted checkout flow to reduce friction.

Yes. Visit docs.riverty.com/bnplto sign up for an enterprise Buy Now, Pay Later integration. You’ll receive test credentials within minutes and can explore the full consumer experience and direct integration options immediately.

Experience merchant-first Buy Now, Pay Later with Riverty

Whether you're rethinking your in-house solution, ready to regain brand control, or looking for a Buy Now, Pay Later provider that prioritizes your business – we’re here to show you what reliable partnership actually looks like.