What is debt collection?

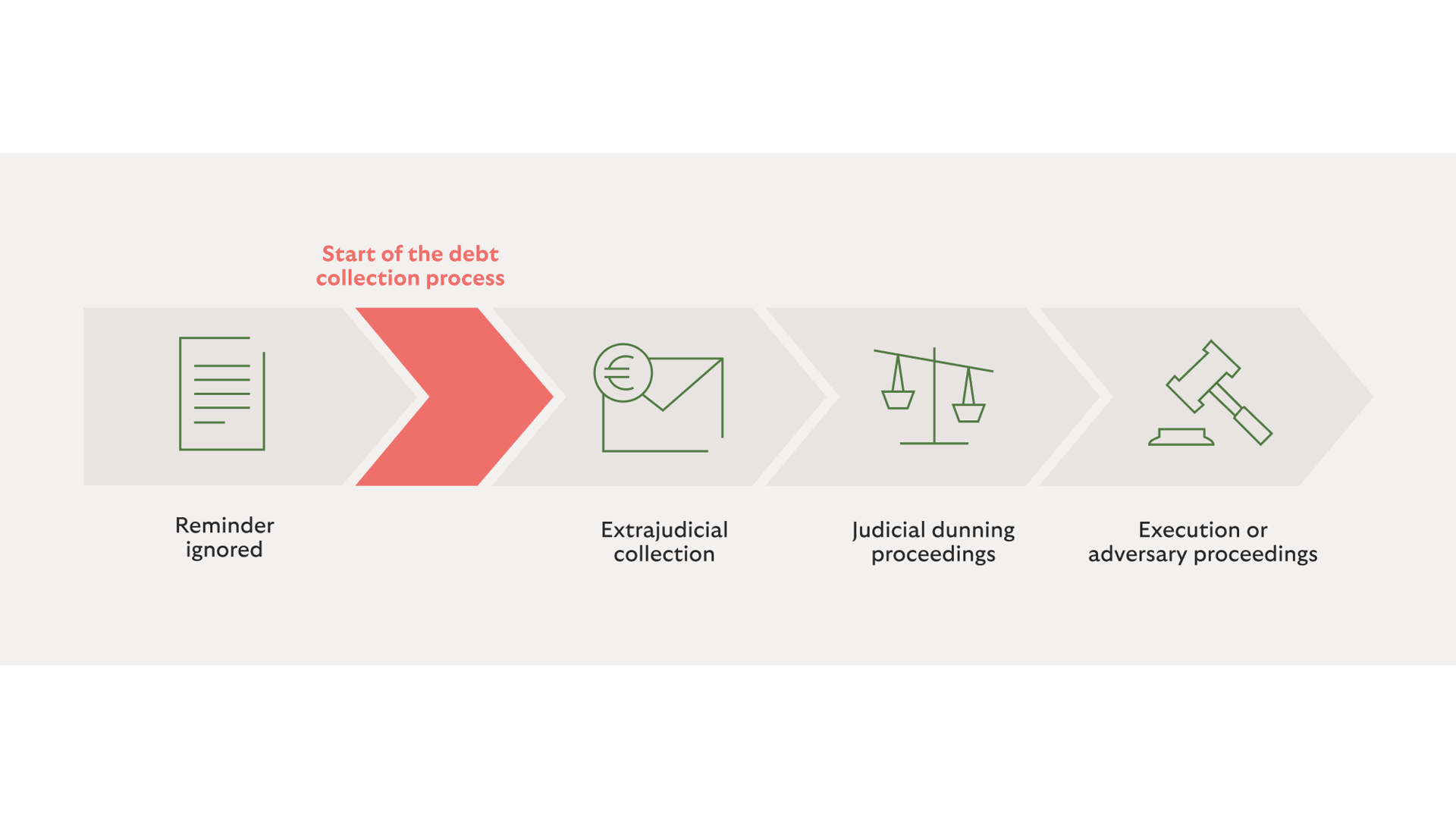

Those who do not pay their bills on time and ignore reminders run the risk of facing a debt collection procedure. Creditors often commission a company specialising in collection activities to collect the outstanding money for them.

In doing so, collection agencies take various measures reaching from written demands to judicial dunning proceedings or even to enforcement, if an enforceable title has previously been obtained for the claim.

Inform yourself here on the basics and the meaning of "collection".

The most important questions at a glance

What does "debt collection" mean?

"Debt collection" stands for collecting outstanding monetary claims that have fallen due in one's own or someone else's name. A collection agency specialises in this kind of activity and conducts the receivables management for its clients.

Collection proceedings are usually initiated when outstanding invoices are not paid despite reminders from the creditor and the latter decides to commission a company specialising in collection activities; this allows the creditor to concentrate fully on its core business activities.

"Debt collection" in simple words

The creditor commissions a collection agency to recover his due debts.

The origins of "debt collection"

The English term "debt collection" means, of course, gathering outstanding sums together. The procedure has its origins in banking. The original Italian banking term "incassare" could be translated as "putting money in the till".

The first companies that specialised in the collection of outstanding claims were founded towards the end of the 19th century. Since 1935, collection has been regarded as a legal service in Germany. Every collection agency has to be registered. You can always check if a firm is registered by looking it up free of charge in the Legal Services Register (https://www.rechtsdienstleistungsregister.de).

How does debt collection work?

Creditors can turn to collection agencies, such as Riverty Back in Flow, to have their receivables collected. The collection agencies then act on the basis of a contract concluded with the creditor. Subsequently, the collection agency contacts the debtor of the claim in order to agree upon the clearance of the outstanding balance. Once the debt is paid, the collection agency transfers the money collected to the creditor.

Commissioning

The creditor grants the collection agency a power of attorney when it is commissioned. With this power of attorney, the debt collection agency represents the interests of the creditor and contacts the debtor of the claim on his behalf.

Assignment of a claim

Alternatively, the creditor can also assign the claim to the collection agency in trust. The agency then collects the debt from the debtor in its own name for the creditor.

Which measures does a collection agency take?

Debt collection agencies can operate in the fields of extrajudicial collection, judicial dunning proceedings and foreclosure. Within the framework of these activities, debt collection companies like us see themselves as intermediaries between creditors and debtors. In most cases, the latter are consumers who have fallen into arrears for a variety of reasons.

Among other things, collection agencies can:

- send out written demands for payment,

- contact the debtor of a claim by phone,

- enquire about the economic situation,

- determine the whereabouts of the debtor,

- verify and respond to objections

- as well as conclude agreements on payment by instalments or deferment of payment.

If these out-of-court efforts remain unsuccessful, the collection agency usually initiates judicial dunning proceedings to obtain an enforcement order.

As soon as an enforcement order or another enforceable title has been issued, the collection agency can also use enforcement measures to make sure the client gets the claim's worth.

Differences in debt collection against consumers and companies

As a rule, consumers enjoy greater legal protection than entrepreneurs:

- Default interest, e. g., may not be set as high for consumers as for businesses.

- If a collection agency asserts a claim against a private person for the first time, it has to fulfil extensive information obligations. This shall enable the private person to easily understand the claim.

Apart from such details, however, the debt collection process is essentially the same in both cases.

Conclusion

"Debt collection" is an important tool for any creditor to recover outstanding money. If the debtor of a claim neither settles outstanding balances nor reacts to the corresponding reminders, the aim is to come to a quick out-of-court agreement. Such an approach is in the best interest of both sides!

If you have received a letter from us, be sure to contact us. We offer various options for settling outstanding debts. Together we will find an individual solution.

Identity

Please understand that for reasons of readability we only use the grammatically masculine form when referring to persons. This always refers to people of any gender identity.