The quiet disruption: The future of banking and why banks will fade into the background

The most disruptive change in the future of banking isn’t explosive – it’s invisible. In the future of banking, services will disappear into ecosystems, becoming frictionless and ambient. These invisible systems will function as payment companions that empower both businesses and customers through human-centric design. Here’s why banks will fade quietly – and what comes next.

Why the future of banking is embedded, invisible, and ecosystem-led

By 2040, the future of banking will be fundamentally transformed through a convergence of technologies and shifting consumer expectations. Traditional banks that once dominated the financial landscape will increasingly move from center stage to background infrastructure, as embedded finance, AI, and digital ecosystems take the lead in customer relationships.

The Fintech 2040 research reveals a profound transition: banking is evolving from a destination to an invisible service. This doesn’t mean banking functions disappear – rather, they become seamlessly integrated into non-financial platforms and daily activities. Imagine purchasing a car through an automotive app that instantly offers financing options based on your financial profile, or a health application that automatically adjusts your insurance coverage after detecting a change in your vital statistics. These scenarios represent the future of financial services where the bank itself becomes invisible.

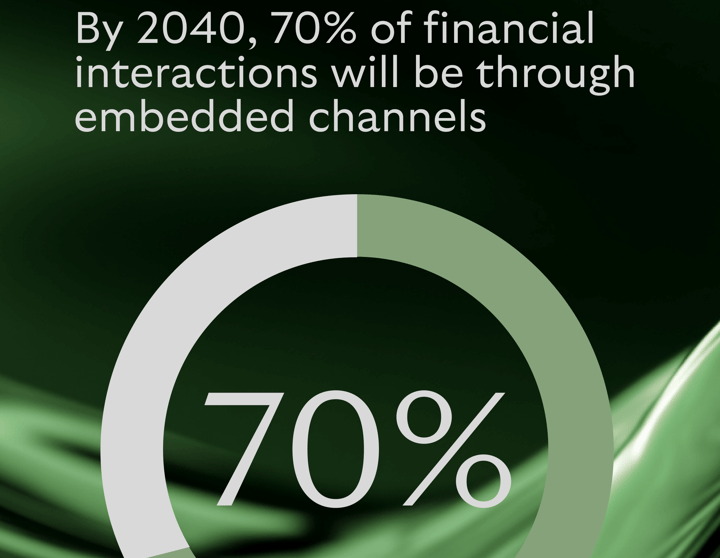

Industry forecasts suggest that by 2040, approximately 70% of financial interactions will occur through embedded channels rather than direct banking relationships. This represents a fundamental shift in how consumers engage with financial services and challenges the traditional banking model at its core.

Preparing for the future of banking: How institutions must rethink their role

For traditional banks to remain relevant in the digital banking future, they must embrace a pivotal transformation from “service owner” to “infrastructure provider.” This shift requires both technological and cultural changes that position banks as essential, if less visible, components of the financial ecosystem.

Key transformations required for survival in the platform-based banking environment include:

- Open API development: Creating robust, secure interfaces that allow seamless integration with third-party platforms

- Ecosystem partnership strategies: Establishing relationships with non-financial entities where banking services can be embedded

- Modular banking architecture: Building flexible, component-based systems that can be deployed contextually across different platforms

- Regulatory expertise as a service: Leveraging compliance capabilities as a competitive advantage in platform ecosystems

A strategic pivot framework for banking institutions includes:

- Assess current direct-to-consumer channels and their long-term viability

- Identify potential ecosystem partners where banking services could add value

- Develop technical infrastructure that supports embedded deployment

- Reposition brand identity and value proposition around trust, security, and invisible enablement

The future of banking will increasingly revolve around providing the rails on which other services run, rather than being the destination itself. Leading institutions are already exploring this shift through banking-as-a-service offerings, embedded finance partnerships, and infrastructure investments.

Responsible innovation: Building trust in the future of banking

As banking becomes more invisible and AI-driven, questions about transparency, consumer rights, and accountability take on new importance. The future of financial services must balance convenience with responsibility to ensure that ambient banking doesn’t mean diminished consumer protections.

Regulatory frameworks such as GDPR, the European AI Act, and the Digital Operational Resilience Act (DORA) are already establishing guardrails for how financial data and automated decisions can be managed. Forward-thinking institutions are positioning these requirements not as compliance burdens but as opportunities to differentiate through responsible innovation.

European Central Bank executive board member Fabio Panetta captured this tension well when he noted: “We must ensure that efficiency gains from technology do not come at the expense of user autonomy and informed consent.” This principle should guide how banking in 2040 evolves to maintain trust even as services become less visible.

Responsible embedded banking requires:

- Clear attribution of financial services even when embedded in other platforms

- Transparent explanation of AI-driven decisions affecting credit or financial access

- Consistent security and privacy standards across all integration points

- Human oversight and intervention mechanisms for complex or sensitive situations

- Operating as trusted payment companions with a human-centric approach that empowers users with transparency, control, and financial wellbeing at their core

By maintaining these principles, banks can transform into infrastructure providers while still preserving the trust that has historically been their greatest asset.

Case for action: Why forward-looking leaders can’t wait until 2040

The transformation of the future of banking is already underway, with early signals visible in today’s market. Consider how Apple Card has successfully positioned a financial product within a technology ecosystem, how Buy-Now-Pay-Later services have embedded financing directly into the shopping experience, or how fintech APIs now power financial capabilities across non-banking apps.

For banking executives, the business case for early action is compelling:

- Ecosystem leverage: First movers gain preferred positions in emerging platforms

- Data advantage: Early integrations create richer customer insights

- Reputational Leadership: Pioneering institutions shape industry direction and consumer expectations

The pace of change means waiting for the future of banking to fully materialize before acting is not viable. Instead, forward-looking institutions should:&

- Explore the detailed roadmap outlined in the Fintech 2040 whitepaper

- Engage innovation teams to identify ecosystem integration opportunities

- Launch pilot embedded finance initiatives to test capabilities and market reception

- Develop strategic responses to AI in banking and platform-based competition

These steps position organizations to thrive in a future where banking happens everywhere, even as banks themselves become less visible to end users.

The paradox of progress: Becoming essential while going invisible

The future of banking is characterized by a fundamental paradox: financial services will become more important and ubiquitous even as traditional banks fade into the background. This quiet disruption will reshape the industry more profoundly than any technology or competitor could accomplish through direct competition alone.

For banking leaders navigating this transformation, the strategic imperatives are clear:

- Embrace the shift from destination to infrastructure

- Develop the technical capabilities for ecosystem integration

- Maintain trust through responsible, transparent embedded services

- Act early to secure advantageous positions in emerging platforms

The institutions that successfully make this transition will remain essential to the financial system even as they become less visible to end users. Those that resist the change risk finding themselves increasingly marginalized as finance moves from dedicated channels to embedded experiences.

Shape the future of finance: Get the complete analysis

Download the Fintech 2040 Whitepaper to discover what's shaping the future of banking and how your organization can stay ahead of the disruption.

Frequently Asked Questions

Banking will become invisible, embedded into digital experiences across industries, powered by AI and secure infrastructure. Financial services will shift from dedicated channels to integrated components within broader digital ecosystems.

Because customer interactions will increasingly take place on non-bank platforms offering seamless financial services. As financial capabilities become embedded in shopping, travel, healthcare, and other experiences, dedicated banking touchpoints will become less necessary and less frequent.

Banks will operate as compliant, trusted infrastructure enabling services across embedded ecosystems. While less visible to end users, they will provide essential capabilities including secure money movement, regulatory compliance, risk management, and financial record-keeping.

AI personalizes finance, automates risk assessment, and powers intelligent financial agents, reducing the need for traditional bank interfaces. It enables contextual, predictive services that can be delivered at the point of need rather than through dedicated banking channels.

By embracing open APIs, embedded finance, and partnerships that position them as essential back-end providers in a platform-first world. Banks that reinvent themselves as secure, trusted infrastructure providers will continue to play vital roles even as direct customer relationships evolve.