Your data. Your insights. Your control.

Get complete transparency into payment performance — through visual dashboards, real-time webhooks or API calls, and exportable reports. Your data, your way.

What Is Riverty Insights?

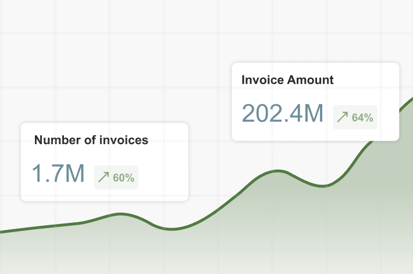

A real-time dashboard that shows you exactly how your payment performance is trending — acceptance rates, revenue patterns, and rejection reasons — so you can optimize checkout, spot issues early, and make data-driven decisions fast.

How it works

Ready to deep dive into your payment data?

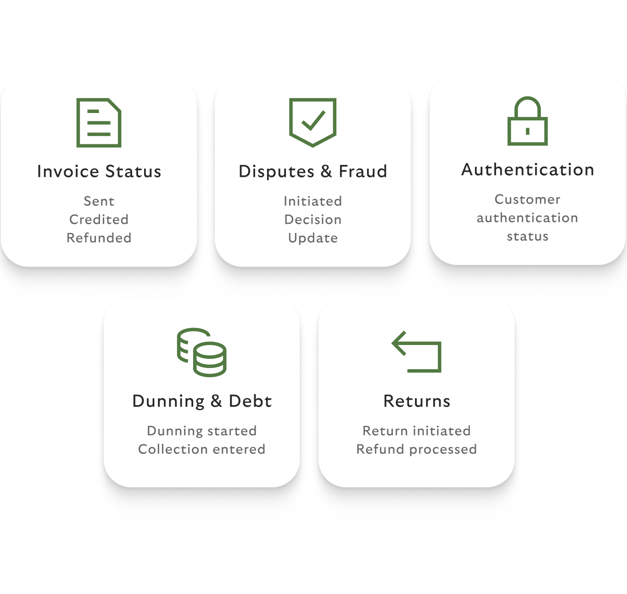

Real-Time Data Events

For large-scale merchants, Riverty offers real-time event notifications via API, Message Queue, or webhooks across the full lifecycle.

These integrations include:

- Automate operations: Trigger workflows automatically when transactions complete, refunds process, or disputes open—no manual monitoring required.

- Improve customer experience: Update your CRM, send personalized communications, and provide real-time order status without delays or manual data entry.

- Reduce fraud and disputes: Get instant alerts on high-risk transactions, failed payments, or dispute activity so you can act before problems escalate.

- Customizable per merchant's tech stack

- Used by enterprise accounts to prevent fraud and reduce operational costs

Why it matters

No waiting on reports

Access live data without delays from BI teams or account managers.

Spot issues before they escalate

Monitor performance proactively and catch problems in real-time.

Complete visibility

Know exactly what's working and what needs attention—no blind spots.

Data-driven optimization

Adjust marketing, checkout flows, and product strategy based on actual usage patterns.

Your direct line to us

Our e-commerce payment experts are available to answer all your questions about payment methods. Simply fill out the form to get in touch with us.

Frequently Asked Questions

Yes. Access is automatically enabled for BNPL merchants via the Merchant Portal.

KPIs are refreshed daily. Enterprise merchants can access real-time updates through API or webhook integrations.

Yes, you can export reports in CSV, XLS, or PDF formats with full customization options.

Absolutely. Riverty never sells or shares merchant data. Access is restricted to your internal team only.

Yes, via webhooks, API, or Message Queue. Technical documentation is available on the “Riverty API” page.

Yes. All webhook communications use HTTPS and signed payloads, ensuring every message is authenticated and protected from unauthorized changes.

bsolutely. You simply register your endpoint once in an easy, self-service manner, and you’ll start receiving real-time event updates automatically — no complex configuration needed.