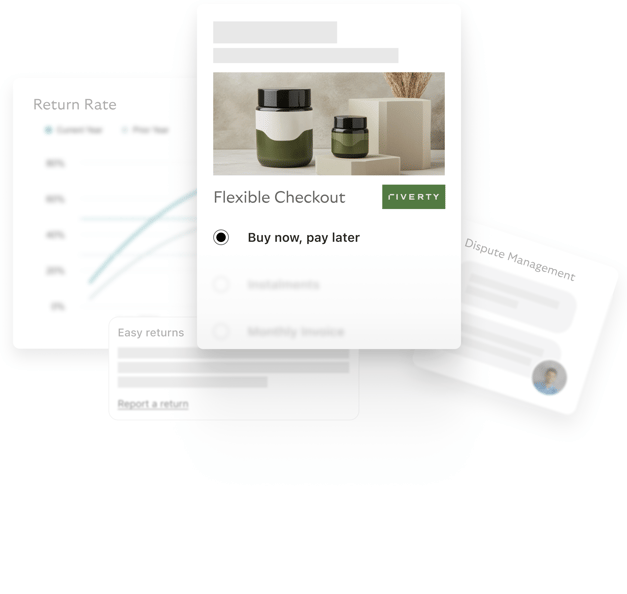

BNPL for merchants who want full control

Take control of your entire payment experience and post-purchase journey, from checkouts to returns and disputes, with a merchant-first BNPL that strengthens your brand instead of competing with it.

Your BNPL, your way

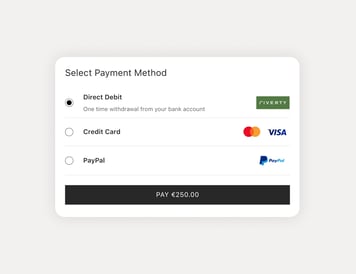

Choose from flexible BNPL product types that work for your customers and comply with local regulations, while keeping every touchpoint aligned with your brand.

Efficiency that scales. Experiences that stick.

From checkout to settlement, Riverty empowers your teams to work smarter and your customers to stay longer.

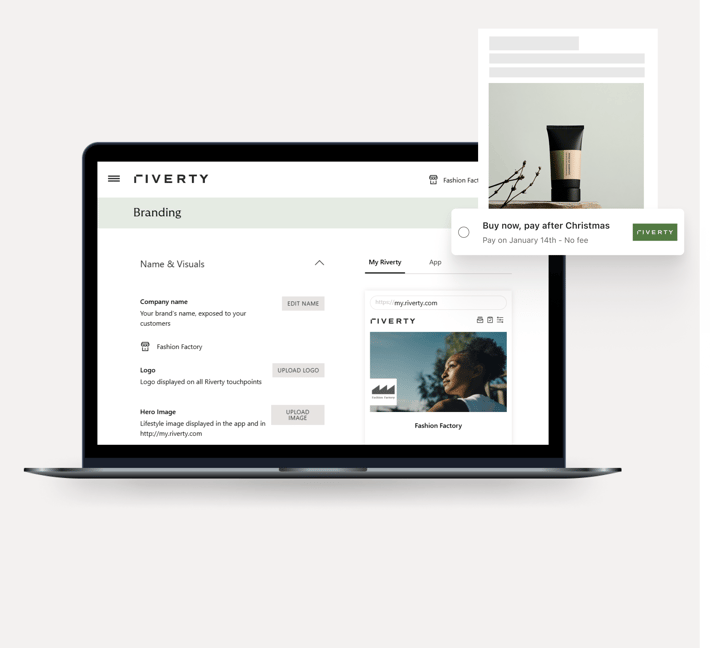

- Maintain full brand control, from customizable checkout messaging to key post-purchase touchpoints, for a seamless, consistent customer experience that builds trust and loyalty.

- Access actionable, real-time insights on payment and service behaviour

- Cut service incidents by 45% with intelligent dispute and return management

- Use AI to resolve customer requests faster via email, voice bot and chat

- Scale your operation without sacrificing the customer experience

- Increase loyalty and repeat purchases by up to +20%

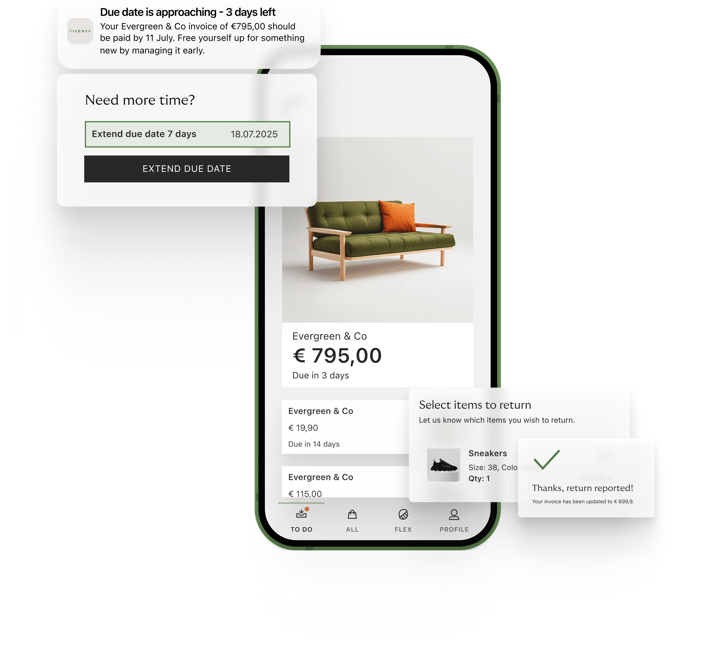

An app that works for your brand

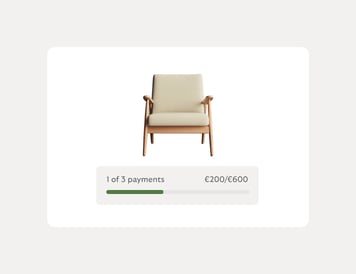

Riverty keeps your brand in the spotlight, with a distraction-free app that shows only your order and return info, never competitor pushes.

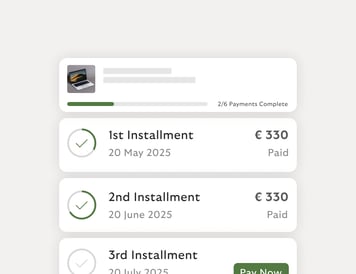

The Riverty App (4.8⭐ on the App Store) helps customers manage their payments, and nothing else. No upselling, no distractions, just clarity and control.

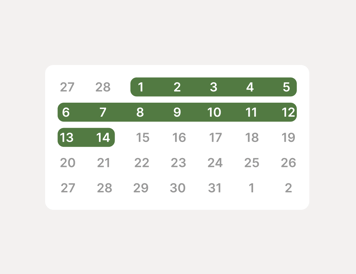

- Split payments or adjust due dates with ease

- Pause payments if needed, without support

- Handle returns directly in the app

- Keep your customer relationship where it belongs: with you

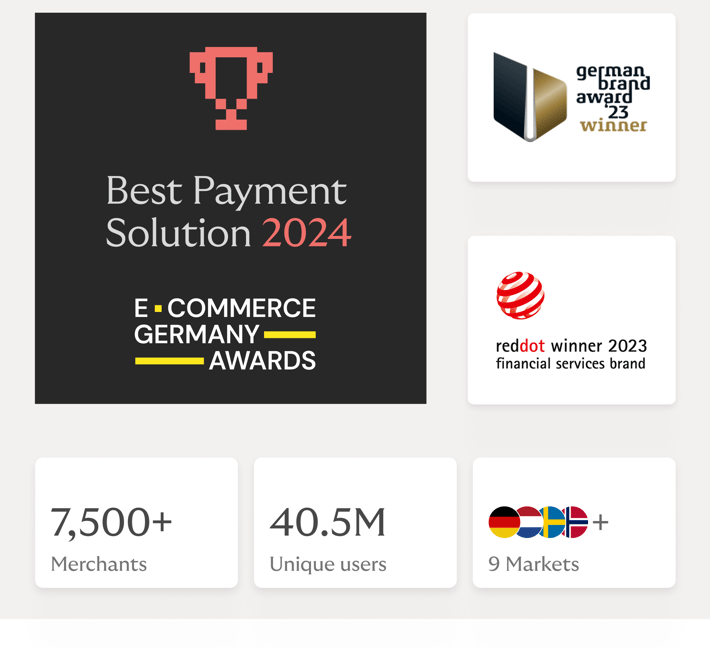

Trusted by Europe’s top retailers

Behind every great customer experience is a payment journey that just works.

Leading retailers across 9 European markets trust Riverty’s Buy Now, Pay Later solutions to combine financial flexibility with operational reliability.

- Boost conversion with smarter, customer-first payment options

- Reduce support load with automated return and dispute flows

- Unlock actionable insights to improve every step of the journey

Get started with our partners

Already using Adyen, Mollie, Pay, Shopify, or others? Keep your current setup and simply add Riverty’s BNPL via our seamless integration.

Whether you're done compromising on brand experience, questioning your in-house setup, or looking for a BNPL partner you can actually trust, Riverty shows you what better looks like.

Your frequently asked questions, our answers

Riverty is one of Europe's largest BNPL providers, operating in 7 countries with seamless cross-border capabilities. Our key differentiators: extensive PSP network for easy activation, industry-low dispute chargebacks through automated management, and our merchant-first approach that keeps your brand in control of the customer experience. Read more about our award-winning approach.

Riverty sends payment-related communications including friendly reminders via SMS, push notifications, emails, and postal letters to ensure customers stay informed. We also send educational content about our app features and services. What we don’t do: promote competing merchants’ offerings or influence customers away from your business.

Contact your PSP for pricing details or reach out to our sales team.

We use real-time risk scoring, our continuously refined machine learning-powered fraud detection, and advanced account takeover protection. Our robust identity verification include BankID, MitID, iDIN, VideoID, Open Banking, and bank-issued OTPs (penny drops) to ensure secure verification of customer identities and access to payment instruments. As a BAFIN-regulated payment institution, we maintain full regulatory compliance across all markets.

Riverty's award-winning customer service handles all payment-related support, reducing average handling times and increasing first-time resolutions by up to 20 percent. We also provide status sharing tools so your customer service team can answer basic payment questions directly.

Key recommendations: implement Riverty messaging and badges on your homepage, implement Riverty sales enabler on your product pages, use our suggested headlines and taglines at checkout (available for both embedded and hosted solutions), and let Riverty handle T&Cs during our hosted checkout flow.

Yes, visit docs.riverty.com/bnpl to sign up and get test credentials within minutes. You can explore the full consumer experience and direct integration options immediately.

Your direct line to us

Our e-commerce payment experts are available to answer all your questions about payment methods. Simply fill out the form to get in touch with us.

Experience merchant-first BNPL with Riverty

Whether you’re tired of losing brand control, rethinking your in-house solution, or considering a responsible BNPL provider, we’ll show you the difference.