Financial and aggregating apps: a helping hand in personal finances.

The use of apps improves financial overview and financial situations of consumers. Want to know how? Read it here.

Remember the winter interim forecast, with GDP growth in the EU of 4% in 2022 and 2.8%* in 2023? Those were some great numbers to look forward to, post pandemic. Unfortunately, things have changed with the invasion of Ukraine. Gas prices are skyrocketing, inflation is shooting up and more and more families are worrying about how to make ends meet.

That makes us think and talk about our own personal finances at Riverty eCommerce Review. Following the news, inflation rates and our own individual increasing monthly spending on bills and groceries, we asked consumers how they keep track of their personal finances. In this blog we outline which tools people use on a regular basis, who have access to consumer financial data and how much trouble people have making payments in the past months due to a lack of money.

People whose financial overview and situation has improved over the last year are more likely to use financial apps and apps that aggregate all their payments

There is no denying anymore that we live in a digital era. Whereas before the pen and paper budget planner helped millions of households, now the digital applications are taking over. On average 71% of consumers are using some form of financial app on the regular basis.

The Dutch are leading in usage (77%) of digital forms of financial planners, the Norwegians come second (71%), the Brits take third place (70%) and Germany follows closely behind (67%).

2 out of 3 consumers use a banking app to keep track of finances

Banks seem to have gained some trust again from the ultimate low due to the 2008 financial crisis. Banking apps are by far the type of app people use on a regular basis. On average 65% of Europeans** have such an application installed on their devices. But we do see a slight cultural difference in numbers: the Dutch take the significant lead again with 71% and has the UK the lowest share of 61% (Germany 62% and Norway 66%).

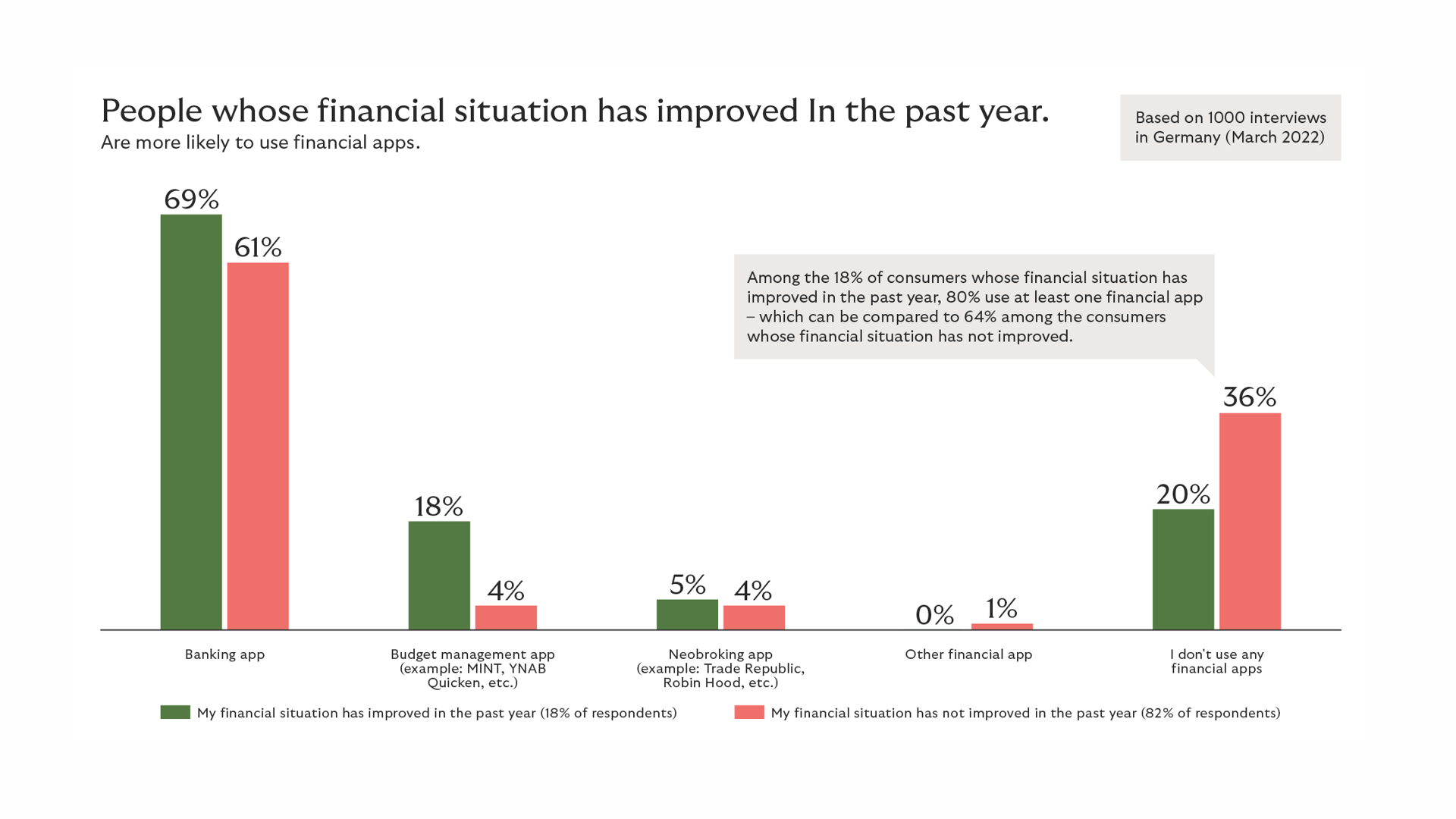

People whose financial situation has improved over the last year are more likely to use financial apps

Budget management apps are present in households, but in smaller proportions. Managing income and spending, creating budgets, helping to paint a clearer picture and save money via a money management software tool, takes on a decent 8% across the four nations. Again with a leading percentage for the Netherlands (11%) and this time, too, for the UK (11%). Slightly lower is the percentage of the German users (6%) and significantly lower in the Norwegian market (4%).

Neobroking is new and for only a few, but for sure one to watch

Accessible digital financial services that help (learning) you trade and invest is what a neobroking app is. A broad consumer audience can let their money work for them in an online brokers platform. Currently still slightly under the radar among the older consumers, but millennials and Gen Z are utilizing neobrokers increasingly more to transform their finances and building efficiency. Afterall, those expensive takeaway coffees and neat white trainers do not come cheap. We see this, too, in our data: on average only 4% makes use of this new phenomenon, with slightly fewer users in Norway compared to the other three countries.

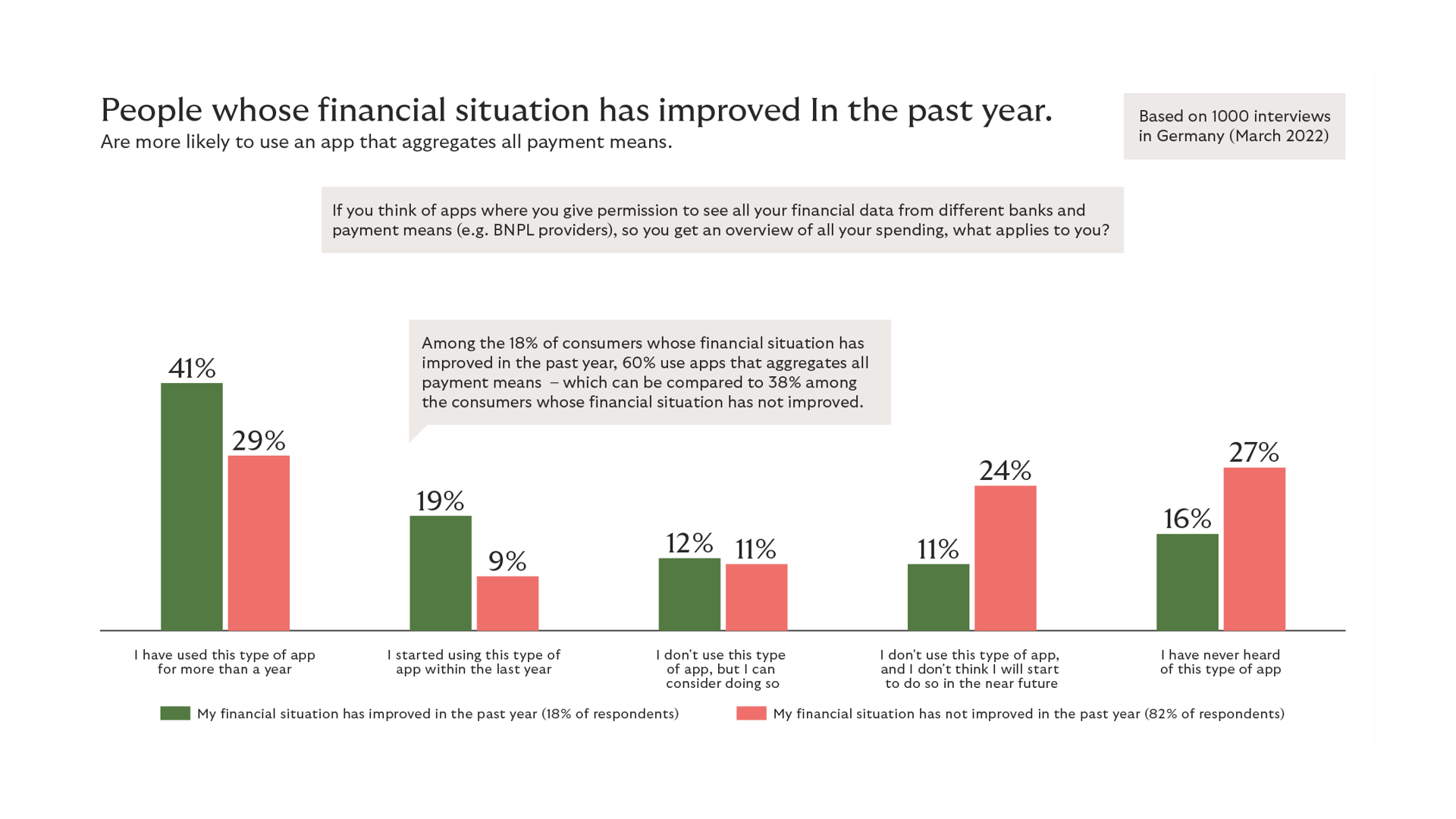

People whose financial situation has improved over the last year are more likely to use an app that aggregates all payment means

We are not aware of how happy or satisfied people are about the apps they use to get overview and insight into their personal finances, we do know that among consumers who think their financial situation has improved, an honorable 41% have used this type of app for more than one year. On the other hand, among consumers who do not think their financial situation has improved: 29% have used such an application for more than one year.

Now, in order to use such an app to keep track of your personal finances, users need to agree with (Payment Services Directive Two) PSD2 or Open Banking: giving banks for instance permission to release their (your) data in a secure form and share it between other businesses and third parties online that are authorized by governments, to create new products and services, such as a budgeting application that overviews two different bank accounts into a third party app. A BNPL (Buy Now Pay Later) provider is a good example here, as those providers fix users an overview of all spending.

The longer you use an app, the more likely your situation improves

From the 1 out of 5 consumers (18%) whose financial situation has improved in the past year, 60% of them use apps that aggregates all payment means, which is positive news. Apps seem to help people with their finances. Data even tells us that the longer people use aggregated apps, the more likely it is that their financial overview improves. Using for more than 1 year shows a share of 38% of people whose financial overview improves. Users who only just started using such an app this past year, have a share of improving finances of 20%. Even more interesting: if you are not using such an app but surely are considering using it, the share of improvement already hits a significant 16%. The negative number come about when people do not know nor want to use an app: of these two options 54% of people say their situation has not improved.

In sum:

Financial overview:

- People whose financial overview has improved over the last year are more likely to use financial apps.

- People whose financial overview has improved over the last year are more likely to use an app that aggregates all payment means.

Financial situation:

- People whose financial situation has improved over the last year are more likely to use financial apps.

- People whose financial situation has improved over the last year are more likely to use an app that aggregates all payment means.

Financial troubledness:

- People who had trouble making payments over the last 6 months are more likely to use financial apps.

- People who had trouble making payments over the last 6 months are more likely to use an app that aggregates all payment means.