Buy Now Pay Later: Championing online shopping and new categories.

The way we pay is changing. Shoppers want experience and flexible payment methods. BNPL is here to stay.

By interacting with our Riverty eCommerce Tracker, we learn about the rising popularity of paying for your order, after it is delivered to your doorstep. We call this Buy Now, Pay Later, or in short, BNPL. This BNPL could either be a payment that covers the full amount all at once, or a split payment that has three different due dates, that each share a third of the due amount.

This blog answers our questions on how shoppers pay in online check out, which methods of Buy Now Pay Later are most popular, how actively do shoppers seek for BNPL payment options when they are shopping and what categories that currently have no BNPL but shoppers would like to use for?

Actively searching for the BNPL option

Buy Now Pay Later is hot and on the rise. The payment method that allows shoppers to pay after they received their delivery, is widely in use among shoppers or has been used at least once in the Netherlands (57%), Germany (68%), Norway (59%) and the UK (42%).

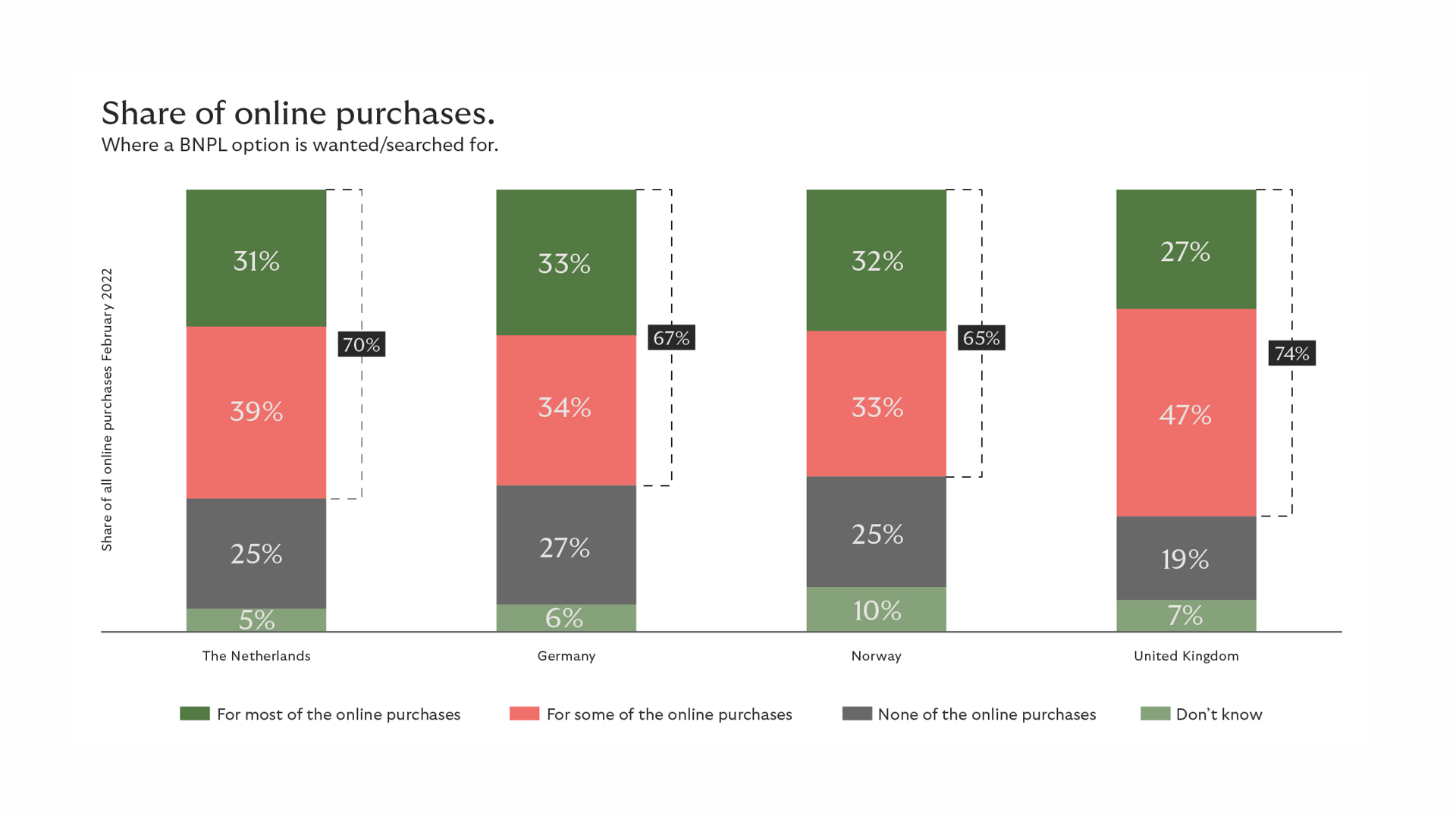

The overall share of BNPL users, (for Most and Some online purchases, all age groups and genders combined) that actively search for is highest in the UK. Nearly 3 out of 4 BNPL users look for a BNPL option in check out – at least for some of their online purchases. The UK also has the lowest share (19%) on online BNPL users that say they never look for BNPL during their purchase journey. When we dig deeper and review the shares per country and specific age groups, this share is even higher.

With the growing popularity of the method, we know that shoppers now also start to actively look for BNPL before they make a purchase. BNPL users that actively seek for webshops that offer BNPL payment, have an overall spend of 53% online and 47% offline” and “The overall spend among BNPL users that never seek out webshops that offer BNPL payment, is 40% online and 60% offline. Regarding shoppers that look BNPL for some of their online purchases, 53% say they do so, versus 47% of shoppers that say they look for BNPL for some of their purchases in physical stores.

Age groups make the biggest differences

BNPL is widely present among the younger shoppers. 36 to 43% of the 18–39-year-olds, say to either look for BNPL for Most of Some of their online purchases.

In other older age groups, there is still ground to win for actively seeking for BNPL payment methods

The age group that is usually a lagger still takes on a decent share of active lookers for BNPL for some and most online purchases: among BNPL shoppers aged 70+ year old still 24 to 31% say that they search for the flexible payment method. And the share of 70+ BNPL shoppers that never looks for BNPL is 11%.

No difference based on gender: men and women look equally as much for BNPL.

The share of Males and females that look for BNPL for most or some of their purchases is the same. The average comes down to 34% no matter the frequency of actively seeking.

Almost a third of Norwegians use BNPL and rule the top four

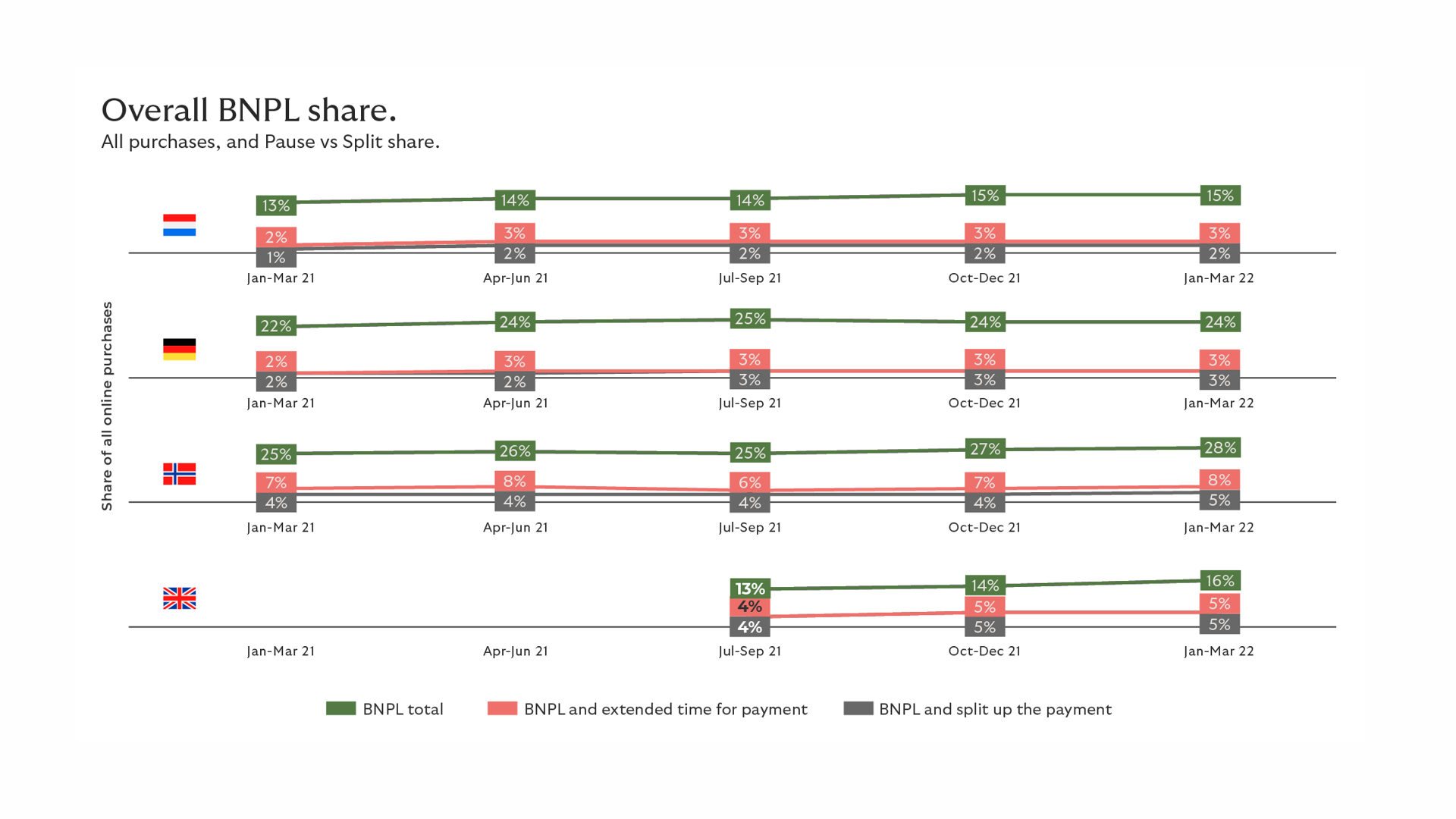

The Nordics country ranks number one in our top four of BNPL usage. 28% of online purchases in Norway are made using BNPL. From the BNPL users here, 8% opts for pausing the payment and paying at a later time, and 5% uses split payments, installments. 8% of Norwegian online purchases are paused payments and 5% of Norwegian online purchases are split, e.g., pay in 3.

Germany is runner up: almost a quarter of Germany's purchases are done via BNPL. Of all German online purchases, 24% is done via some form of BNPL. The share of pausing and splitting payments among these purchases is stable at 3%. From the UK online purchases, 16% paid for via BNPL. A small growth in BNPL is visible in the graph, as we see how the 14% share from December 2021 goes up to 16% in March 2022. The averages of the Pause and Split Payments go up with 1% in the same time frame. Most ground is still to win in the Netherlands. 15% of Dutch online purchases are made via use of BNPL. From the BNPL purchases, 3% is a Pause Payment, and only 2% of online purchases is a Split Payments option in check out.

The numbers in the graph show little fluctuation. That means our tracker is reliable, as well as opportunity for growth. As age groups are looking actively for BNPL when shopping online, merchants could consider offering BNPL methods in their checkout environments. BNPL's popularity is unstoppable.

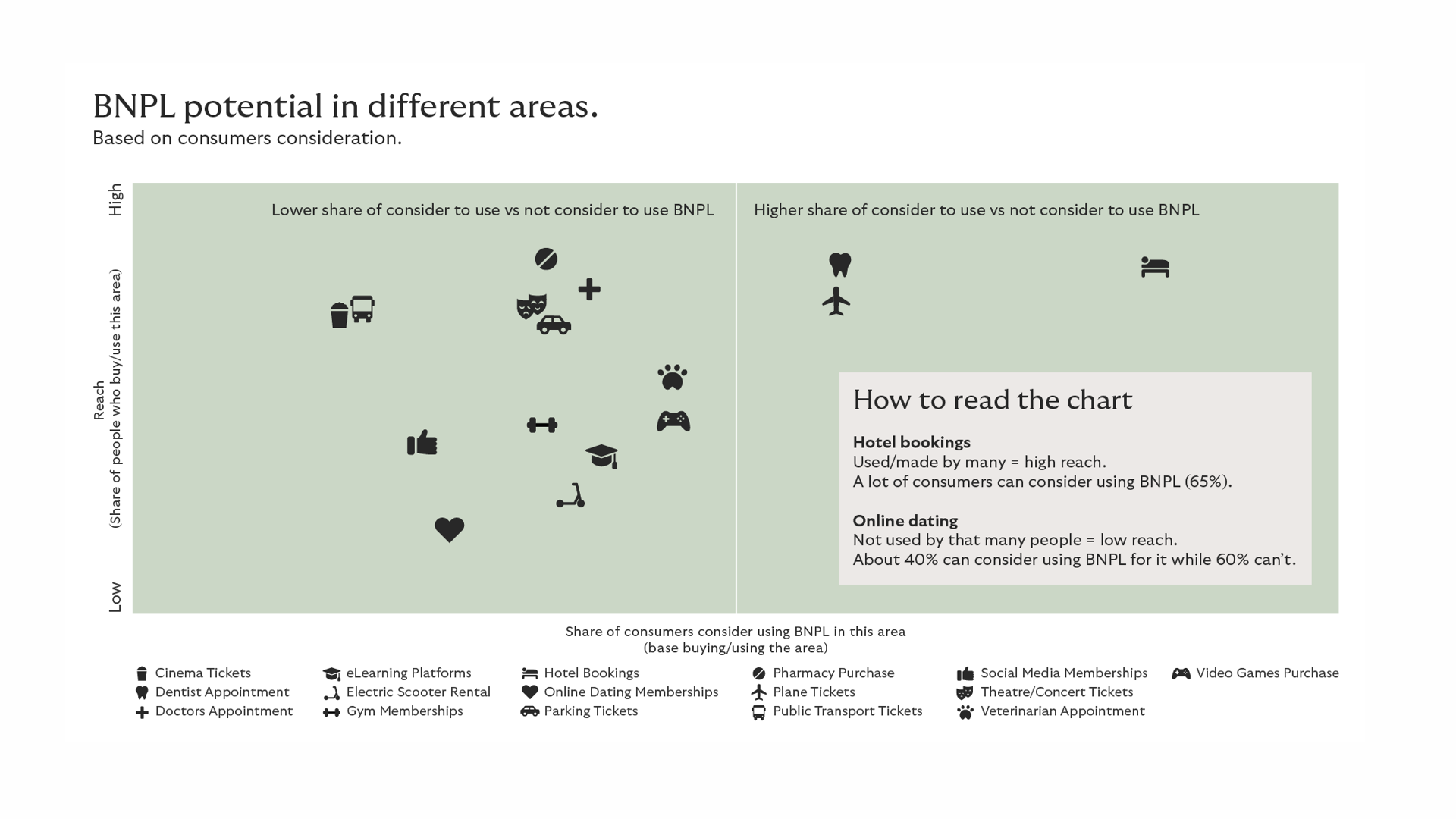

However, it is not available yet in any thinkable category. We asked consumers where else they would like to see and opt for BNPL. Hotel Bookings, Plane Tickets and Dentist Appointments are often appointed to be next for BNPL and are categories used by many people. Another interesting category to research for BNPL opportunities is the world of Online Dating. About 40% of consumers use such an app or platform and is popular among the younger age groups (that use BNPL more often than older age groups). However, Online dating has one of the lowest BNPL consideration shares.