Efficient debt collection for energy suppliers: Riverty – keeping your finances in flow

Learn moreReducing operational costs with accounting automation

Learn moreRiverty is an expert in debt collection for insurance companies and has more than 20 years of experience in the industry as a partner of renowned insurance companies. In over 350,000 new claims per year, we recover outstanding premium receivables and maintain more than 100,000 customer relationships for insurers every year - even in critical phases of late payment.

Whether you are a group, a division specialist, a direct insurer, InsurTech or a regional mutual: We support you in processing your claims. Our industry-specific expertise covers all lines of business, from property, liability, accident and vehicle insurance to health insurance with its special requirements as personal insurance. See some references here:

We understand the insurance business

Riverty's insurance team is staffed with industry-specific qualified personnel: Employees in the areas of key account management, processing or legal have an insurance background.

We also work closely with a large network of experts - such as specialist lawyers for insurance law, management consultancies and the chair of insurance law at Coburg University of Applied Sciences.

We understand the insurance business

Riverty's insurance team is staffed with industry-specific qualified personnel: Employees in the areas of key account management, processing or legal have an insurance background.

We also work closely with a large network of experts - such as specialist lawyers for insurance law, management consultancies and the chair of insurance law at Coburg University of Applied Sciences.

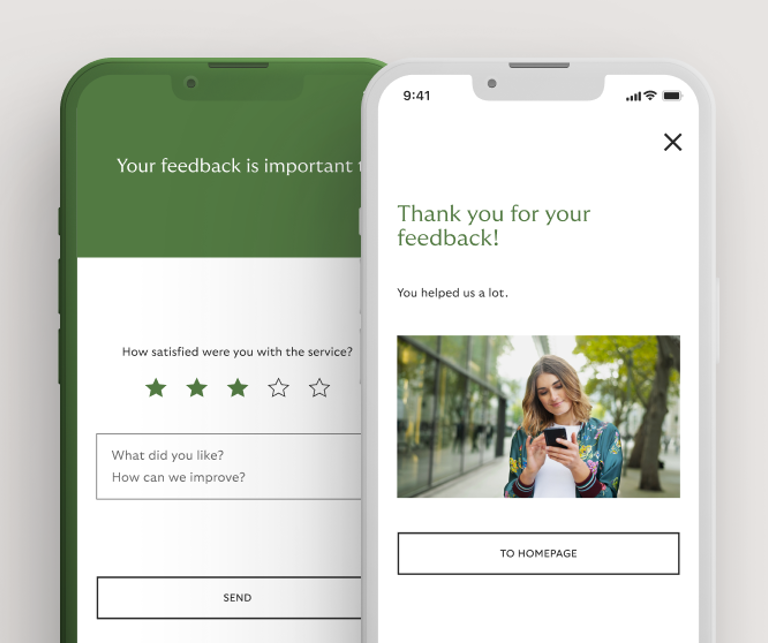

Customer expectations of flexible, customised products and digital communication are also becoming increasingly important in the insurance industry. Together with Riverty, you can provide your customers with a seamless digital customer journey throughout the entire lifecycle - including communication in receivables management. The majority of end customers of insurance companies now settle their outstanding claims completely digitally.

New, digital competitors are entering the market and customers are increasingly willing to switch. It is important for insurance companies to secure the loyalty of their customers. The Riverty approach: retaining customers with fair and personalised receivables management and avoiding premature contract terminations for customer relationships that are worth keeping.

Harald Hennes

Head of Debt Collection, Barmenia Versicherungen

We support you with outstanding receivables - with fair and digital debt collection processes. Benefit from our industry expertise.